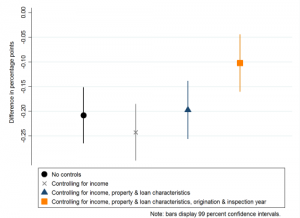

Graph 1. Difference in mortgage arrears (high energy efficiency vs low energy efficiency) – BoE

New research from the Bank of England on the link between energy efficient (green) housing and mortgage performance in terms of arrears has recently been published.

The researchers analysed more than 1.8 million UK loans as at the end of 2017, matching Energy Performance Certificates (EPC) and comparing performance of highly energy-efficient homes (A, B and C labels) with medium (D) and low (E, F, G) energy efficient homes.

The results were:

- Under all scenarios, arrears were lower for high energy efficient homes compared to medium and low energy efficient homes.

- Controlling for income, property and loan origination year still resulted in lower arrears.

- They concluded that an energy efficient property is a good predictor of a lower mortgage risk.

- The findings provide overwhelming support for the concepts underpinning the Energy Efficient Mortgage Initiative and the desire to improve the quality of Europe’s housing stock, improve borrowers’ financial position and reduce risk in the mortgage market.

To read the full article, please click here.