DESIGNING THE NEXT GENERATION OF VALUATION GUIDANCE FOR

SUSTAINABILITY IN RESIDENTIAL PROPERTY

The REVALUE partners analysed over 120 000 data points across four countries as part of its quantitative research to better understand the relationship between energy efficiency and value.

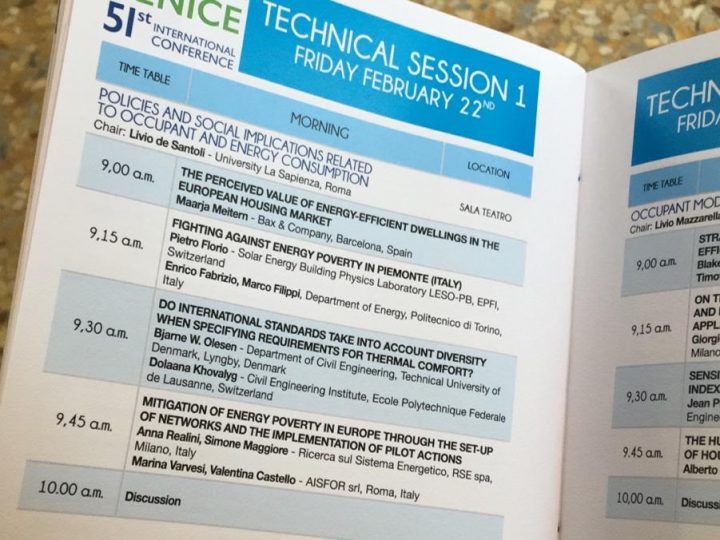

Updating international guidance for property valuation professionals encourages valuers to better reflect the benefits of energy efficiency upgrades in appraisals.

By taking this guidance to market, investors and financers will start to reflect energy efficiency in their risk assessments and cash flow projections, potentially unlocking additional streams of finance.

This can all help buyers and owners in making retrofit decisions and may well lead to more energy efficient homes.

PROJECT PARTNERS:

RECENT NEWS: