The Green & Healthy Homes Conference took place last October. The conference was organized by Maastricht University and supported by REVALUE, ECCE, and MIT. The event brought together lenders, investors and researchers to discuss policies and trends in investments in green housing. Practitioners confirmed that buyers or tenants do not yet value energy efficient homes, so no higher sales price or rents can be commanded. However, it is expected that energy efficiency will be reflected in value in the future and regulation may drive this change. New homes already need to meet stringent quality requirements, and sooner or later, regulation will also apply to existing dwellings, something that may lead to ´stranded assets´ that cannot be rented out by investors if

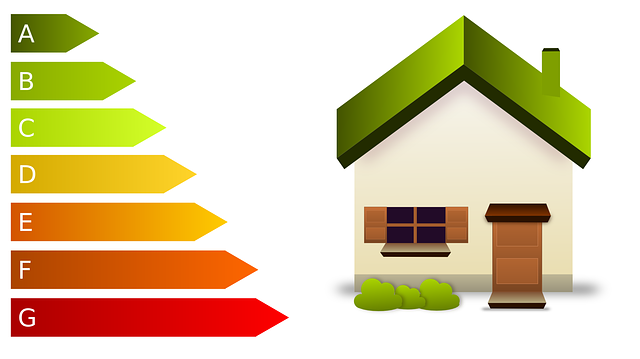

dwellings do not meet minimum energy quality criteria. The United Kingdom is already moving in that direction, prohibiting lettings and lease renewals for dwellings labelled ´F´ and ´G´ by 2018, and extending that regulation to existing leases by 2023. In secondary markets, the slowly improving quality of the building stock is also likely to lead to ´brown discounts´ for outdated stock as better quality homes will become widely available. In addition, major banks across Europe are already offering better conditions for financing the purchase of green homes or retrofits, including favourable loan durations and interest rate discounts of 20-50 basis points.