On Friday February 16, SAVILLS hosted the REVALUE Focus Group Meeting at their headquarters on Margaret St, London. REVALUE partners (RICS, Savills, VanHier accountants, Bax & Company, Luwoge & Maastrict University), presented their results from two years’ worth of research, investigating the links between energy efficiency and values in residential rented stock, across selected European countries.

Experienced practitioners in the industry – housing providers, valuers and financiers – attended the event to discuss the findings. All presentations concluded that the REVALUE research project cannot yet provide clear evidence that energy efficiency is currently a ‘value driver’.

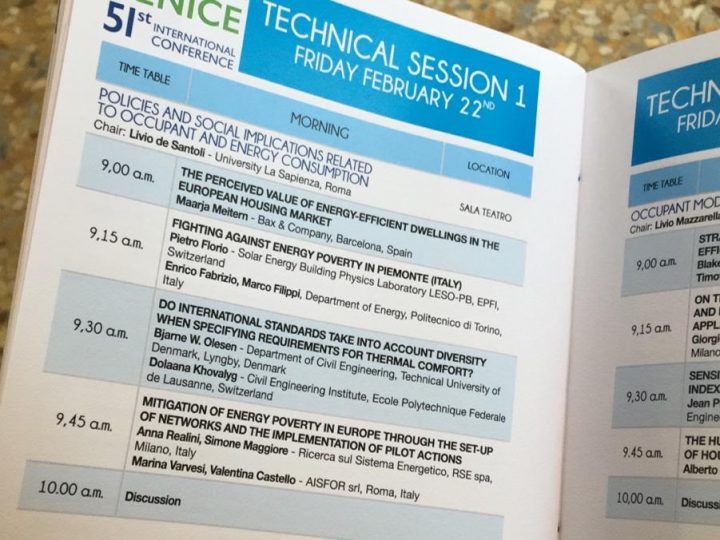

Sarah Sayce chaired the meeting, and welcomed everyone with an overview of REVALUE’s methodology and work streams. Then Juan Francisco Palacios Temprano of Maastricht University, presented his quantitative analysis of Energy Performance and Valuation of Social Housing in Europe. His findings showed that reported values of dwellings remain dominated by traditional value factors and energy efficiency is not a dominant factor of value. However, double glazing has a significant effect on assessed valuations.

Sarah then presented her findings from RICS, focused on How valuers reflect Energy Efficiency in Europe. She revealed that valuers have found little evidence that EPCs ratings impact the market value of residential assets and that many clients still do not ask any questions about energy efficiency – nor are prepared to pay for additional work.

She was followed by Rolf Bastiaanssen of Bax & Company, who presented his talk on Long-term sustainable investment planning, highlighting the importance of available quality data to accurately analyse the relation between building energy efficiency and value. He highlighted that value and risk are not considered as main drivers, while corporate responsibility is. However, vision-driven backcasting exercises developed by the REVALUE project showed response at strategic level, increasing confidence in feasibility and willingness to invest.

The participating practitioners were then asked which of the findings they deemed most important and what recommendations they would send to EU policy makers, valuers, commissioning clients and portfolio owners.

These findings will be reviewed in REVALUE’s final report, to be published within the next few months.

If you are interested in finding out more about the research, contact us.