The Value of Energy Efficiency

The REVALUE project has been a journey, undertaken at a time of change in market environments. It has led to a deeper understanding of the role that valuers and their clients play. The project process and findings are outlined in a final report.

REVALUE Project Story

REVALUE is a three-year project to develop international guidance for property appraisers, incorporating the collection and easy analysis of relevant evidence. This will help valuers to reflect the value of energy efficiency (EE), in their valuations of social and private housing stock.

It is hoped that by introducing guidance to practitioners in the market, additional income streams could be recognised and other value drivers found, which might assist buyers and owners consider EE retrofit decisions.

What is REVALUE?

Designing the Next Generation of Valuation Guidance for Sustainability in Residential Property.

REVALUE focuses on revising and strengthening the requirements of due diligence and reporting in relation to the energy efficiency and sustainability characteristics of residential properties. The project includes provision for the creation of targeted training material for valuers.

Connecting Building Performance and Value: The State of Play

This presentation focuses on the current rules of engagement, the Sustainability Taskforce and how REVALUE and the European Green Mortgages Initiative are contributing to connecting building performance and value. This presentation was part of the Performance lab at the Ecobuild conference in London, and it was conducted by REVALUE team members Fiona Haggett, UK Valuation Director (RICS) and Sarah Sayce, Professor in Sustainable Real State (Royal Agricultural University) together with Philip Parnell (Deloitte) and Zsolt Toth (RICS).

REVALUE D1.1. Overview of National and European Valuation Techniques

This document provides an overview of currently available valuation techniques existing on national and European levels. A summary of European accountancy and sustainable investment practices in the residential real estate sector data are provided.

REVALUE D1.2 Comparison of valuation techniques

The aim of this deliverable is to provide a systematic overview of the Key Performance Indicators (KPIs) used for property valuation.

REVALUE D1.3 The REVALUE valuation framework

This document proposes a framework for more detailed and consistent consideration of energy efficiency, sustainability and related characteristics when valuing a residential property, both within the private and social/public sectors.

REVALUE D1.4 Set of validated recommendations for European norms and standards

This brief paper details the outputs of the REVALUE project in relation to its core aim to “lead the development of appraisal norms and standards that recognise Energy Efficiency Value in social and private residential real estate.” It confirms that the project has taken place in collaboration with the RICS, the leading valuation professional body. It details that the various strands of work that have taken place throughout the project have led to clearly defined outcomes. At the start of the project RICS, in their mandatory standards, provided some recommendations towards the collection of sustainability data, where available, for potential inclusion in reports.

REVALUE D2.2 Building Efficiency Guide: Raising Awareness of users to building archetype specific renovations and data collection options

This is an introduction of the Building Efficiency Guide (BEG). The guide is an information and planning tool to be used by valuers, investors, and design professionals during the planning phases of a project. The guide can assist in establishing the results of design decisions with their relationship to energy use, technical and economic aspects and even help in materials selection of the major building components. This document clarifies the benefits to those users and the owners. This document combines an overview of the BEG with images from the English version along with explanations and tips on how to use the tool for a particular building.

REVALUE D2.3 Report identifying existing bottlenecks and scope for improvements in benchmark investment programmes

This deliverable explains the drivers for retrofit investment projects by affordable housing providers and explores options to increase the scale and impact of possible improvements. Four case studies were carried out, in the Netherlands, the United Kingdom, Germany and Sweden. In addition, two country-level focus group meetings, in the Netherlands and in the United Kingdom – (involving representatives from the social housing sector, lenders and valuers) were organised to understand the bottlenecks which would influence the funding and uptake of energy efficiency (EE) investment programmes.

REVALUE D2.4 The impact of Energy Efficiency on residential real estate values

This deliverable details the findings of six roundtable discussions undertaken in 2017 and then discusses the implications both for the professional body and the REVALUE project findings.

REVALUE D2.5 Recommendations for housing providers on valuation techniques and strategies in their investment programmes

In order to develop a deep understanding of housing providers, two members of the REVALUE team undertook a series of deep (1.5 – 2 hour) semi-structured interviews with decision-makers in the housing sector. The results of these deep interviews are documented in Part A of this deliverable and provide the understanding required to make recommendations to housing providers as to how they might be able to deliver energy improvements within their portfolios. Although the results of the interviews provide the bedrock for this report, the key objective of the task was to make recommendations on valuation techniques and strategies in investment programmes of housing providers. These are covered in part B of this document.

REVALUE D2.6 Data-driven case studies into asset energy renovations

This report combines an overview of the methodology and outcomes of the 4 individual reports on “Data-driven analysis and strategies for asset energy renovation”. Four confidential reports were produced for each individual REVALUE pilot country (the United Kingdom, the Netherlands, Sweden, Germany). The data-driven cases studies, described in this report, explore the trade-offs between different asset energy renovation strategies. The case studies developed a custom investment planning model to project the impact of various investment strategies on key financial and energy indicators over different investment periods.

REVALUE D3.1 Assessment of the current practice of financiers with regard to investments in Energy Efficiency of residential real estate

One of a series of short reports detailing different aspects of qualitative research conducted in 2017 as a part of the REVALUE project, this deliverable focuses on the current practice of financiers in regard of investments in Energy Efficiency in residential real estate, primarily within the social rented sector but with reference also to lending to real estate residential developers and individual borrowers to fund house purchase. In other publications of REVALUE, detailed information regarding the valuation techniques and practice were assessed. The positioning and strategy of owners of residential real estate are key elements in our research that are integrated throughout the documents of the REVALUE research.

REVALUE D3.2 The potential future impact of energy efficiency on capital values of residential buildings

This document speculatively explores possible future impacts of energy efficiency on rent and capital value in residential buildings. It is acknowledged that energy efficiency alone cannot deliver against the intended targets: meaning that unless there is an intention to complete demolish and rebuild existing stock, the achievable levels through refurbishment will not eliminate the need for operational energy. Changes to the energy supply will be required. Therefore, the goal is to inform the target audience of policymakers about possible scenarios and impacts, and how this may inform policy options.

REVALUE D3.3 Energy Performance and Valuation of Social housing in Europe: a quantitative analysis

This report aims to shed some light on the extent to which energy efficiency is associated with reported valuations undertaken for social housing landlords. The study is based first on international evidence from the academic literature and second on the results of an extensive regression analysis of social housing in selected EU countries. The results of the literature review show that a majority of quantitative studies find that overall housing market prices are influenced upwardly by the energy efficiency levels reflected in Energy Performance Certificates or their international equivalents; the extent of the influence depending on the extent of the levels and a range of other factors including geography and market conditions.

REVALUE D3.4 Cash flow components

This document surveys the literature exploring the different channels through which energy efficiency might affect the final value of a property. It uses the discounted cash flow (DCF) method as a framework to explore the factors to be considered when computing the present value of a property. In a DCF valuation exercise, property values are the discounted sum of net operating income over the investment period and the discounted terminal value at the investment horizon. Based on this framework, we describe the empirical evidence exploring the link between energy efficiency and each value component.

REVALUE D3.5 Cost of Capital

The purpose of this deliverable is to provide an analysis of the potential effect of energy efficiency on the cost of capital to finance – affordable – rental dwellings. The note is based on an up-to-date review of the scientific literature on this topic, and a review of expert opinions extracted from a roundtable organized last year in Maastricht.

At the individual project level, the cost of capital results from the weighted sum of the cost of equity and cost of debt associated to the asset. The empirical evidence linking environmental performance of assets to their cost of capital is still limited. However, there seems to be a consensus in the academic literature suggesting that sustainability performance of real estate is associated with lower systematic risk to both the lender and the asset owner, both in housing and in commercial real estate.

REVALUE D4.1. Summary of professional valuer regulation and regulation standards

This document assesses the current relevant norms and the ideas and assessment of potential future changes in the practice and use of norms and standards. Therefore, this document can be seen as an important hinge document that on the one hand looks at current practice and on the other hand explores possibilities in the way these standards and norms can change or be revised over time.

REVALUE D4.2 Professional valuation guidance: roadmapping the development process

This document describes the RICS guidance development process, outlines key stakeholders in the development of guidance, and details a proposed action plan for engaging these stakeholders.

REVALUE D4.3 Professional body standards relating to the valuation of residential real estate concerning energy efficiency

This document presents a short account of the International Valuation Standards (IVS) and RICS (Royal Institution of Chartered Surveyors) standards in relation to the assessment of energy efficiency for the valuation of residential real estate. It also makes reference to the standards produced by TEGoVA (the European Group of Valuers’ Association) but notes that these are advisory not mandatory. It does not duplicate the material already reported in ‘Summary of professional valuer regulation and regulation standards’ (Deliverable 4.1); instead, it provides greater detail as to the process that is both mandated and advised for valuers.

REVALUE D4.4 Synoptic Report

This document presents a synopsis of the findings and a reflection on those findings and the lessons learned during the REVALUE project. The main findings from the project relate to valuation norms and standards; the matter of data, including EPCs; and the motivations and barriers to investment policy motivation and barriers. Among a large number of findings which have been the subject of separate papers (Deliverables) some key findings have emerged.

The findings have led to reflections and ‘lessons learned’. The ambition to achieve a much more energy efficient stock is a journey. Progress has been made; and it remains the case that social housing providers are motivated, not just by investment financial returns but by their mission to improve the comfort and wellbeing of their tenants and help lift them from fuel poverty.

REVALUE D5.3 Dissemination to Valuation Profession report

This document presents a summary of the dissemination to valuation professionals that have taken place both during the REVALUE project and planned for after the project reaches its formal end point. RICS has interacted with the professional valuation community throughout the REVALUE project, both formally and informally. Further, dissemination to valuers has formed a crucial part of the research methodology.

REVALUE D5.4 Dissemination to accounting industry report

In this report the aspects of financial accounting and auditing in regard to the valuation of properties are discussed. The accountant (also called auditor when he/she performs an audit) will have to rely, to a large extent, on valuation reports from the valuers in regard to the value of the properties.

REVALUE D5.5 Dissemination to energy assessment and real estate industry

This document will, firstly, provide an overview of the stakeholder engagement process that REVALUE partnership have gone through over the course of the project. It will list the key activities that were organised in order to gather insights from market participants and it will provide an overview of the topics discussed. Secondly, it will provide an overview of

the dissemination and communication activities that Luwoge Consult organised in the project. Luwoge presented norms and valuation techniques as well as relevant findings to EURHONET. Other target audiences could include BREEM, LEED, DGNB, European Breen Building Council or Green Star.

REVALUE D5.6 Second Version of the Communication Package

This document presents the communication tools produced according to the second version of D5.1 Dissemination & Exploitation Plan, which aims to ensure that basic information about the project and the outcomes becomes available to a wider audience including the general public as well as the particular target groups aimed at for dissemination and exploitation of project results.

REVALUE D5.7 Presentations at public events report

This deliverable is based on the REVALUE Dissemination & Exploitation Plan. As such, it uses the targeted stakeholder categories set out in the plan and aligns with the objectives outlined at the start of the project. The aim of the REVALUE project is to stimulate investment in energy efficiency in residential buildings through better recognition of the business case for EE measures for residential investors. The aim of disseminating the results of the project was to advance market transformation, by endeavouring to reach the widest possible audience.

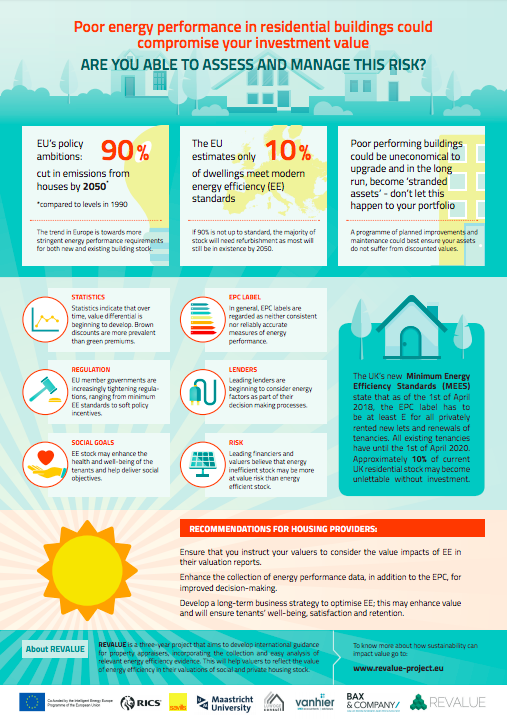

Fact sheet for housing providers

The REVALUE project partners have published a fact sheet for housing providers, outlining the priorities and providing recommendations, as housing providers increasingly recognise that poor energy performance in residential buildings could compromise investment value.

For the full fact sheet, please click here.

This fact sheet is now also available in Dutch here.

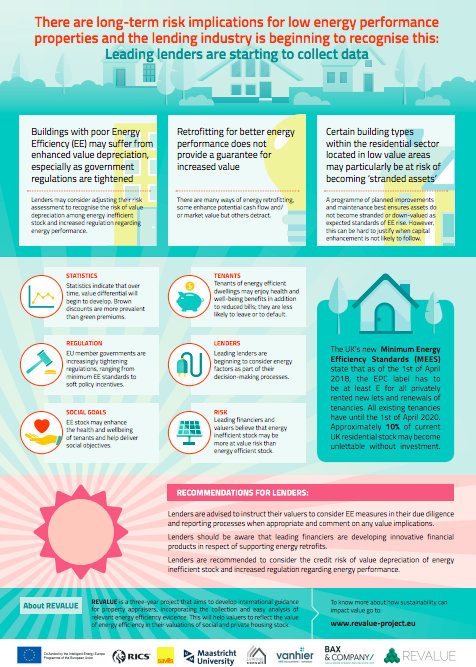

Fact sheet for lenders

The REVALUE project partners have published a fact sheet for lenders, outlining the priorities and providing recommendations, as leading lenders are starting to collect energy efficiency data. There are long-term risk implications for low energy performance properties and the lending industry is beginning to recognise this.

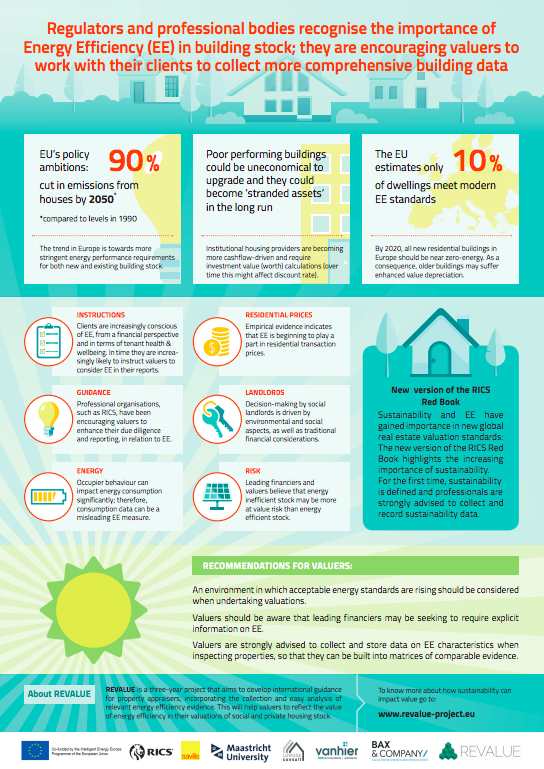

Fact sheet for valuers

The REVALUE project partners have published a fact sheet for valuers, outlining the priorities and providing recommendations. Regulators and professional bodies are recognising the importance of energy efficiency in building stock; they are encouraging valuers to work with their clients to collect more comprehensive building data.

For the full fact sheet, please click here.

This fact sheet is now also available in Dutch here.